Protect Your Business From The Unexpected

Cyber Liability Insurance

Just about any organization that uses technology to do business faces cyber risk. And as technology becomes more complex and sophisticated, so do the threats we face — which is why every business and organization needs to be prepared with both an effective cybersecurity plan, and a cyber liability insurance policy to manage and mitigate cyber risk. Regardless of size or industry, Joyce Insurance Group offers a Cyber Insurance Program that can help better protect your business. Contact us today at (570) 655-2831 for a Free Cyber Risk Consultation.

Free Cyber Risk Assessment

Cyber Risk Q & A

What is a Cyber Risk?A cyber risk is a financial loss, disruption or damage to the reputation of an organization as a result of technology systems. All it takes is one fund(s) transfer fraud, ransomware, or email compromise to cripple a company.

What can organizations do to protect themselves from a Cyber Risk/Threat?Preparation is key to limiting a potential cyber-related event. Every business and organization should be prepared with both an effective cybersecurity plan and a cyber liability insurance policy.

- Our Cyber Liability Insurance Program includes a review of your information security procedures and evaluation of potential risks, which is led by an in-house Cyber Liability Insurance Specialist.

- Upon completion, our team will provide you with risk report, recommended technology plan and a cyber liability insurance policy tailored to your technology needs.

- In addition, your company and staff employees will receive basic training on proper cyber security hygiene to help reduce future risks.

How can Cyber Liability Insurance protect you?A cyber liability insurance policy can cover nearly anything and everything that relates to cyber incidents and technology failures, such as:

- Stolen funds: If social engineering leads to a fraudulent funds transfer or financial loss, a cyber policy can help to recover the funds.

- Lost business income: A cyber policy can cover financial losses when a security incident brings your business offline.

- Breach response costs: A cyber policy can cover legal, incident response, forensics, and PR costs following a breach, as well as the costs to notify your customers and provides credit monitoring.

- Cyber Extortion: Cyber policies can cover the costs to respond to a ransomware incident, including money, securities, and even crypto currencies paid.

- Reputational harm loss: If your business loses money as a result of negative press, a cyber policy will help to make you whole.

- Reputation repair: A cyber policy will pay for PR to restore your reputation if you’re impaired by a security failure.

- Computer replacement: Replace your computer systems negatively impacted by viruses and malware.

Who needs Cyber Liability Insurance?Simply stated, any business or organization using a computer and connected to the internet. Smaller businesses are often targets of cybercriminals including:

- Healthcare

- Retail & E-Commerce

- Real Estate

- Contractors

- Non Profits

- Public Sector

- Energy

- Legal

- Manufacturing

Cyber Risk 101

As our reliance on technology and data continues to increase, cyber risks do as well. Learn more about these risks, and how the services offered can help you protect your business.

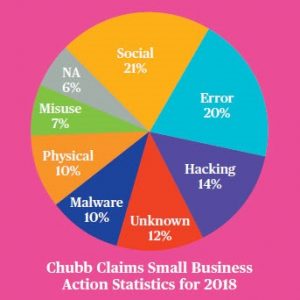

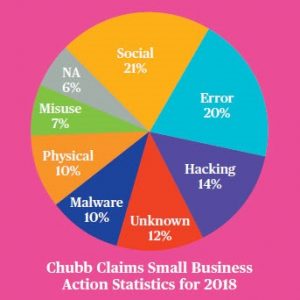

Cybercriminals Increasingly Target Small and Midsize Businesses

Although large-scale cyber incidents garner major media focus, data shows that cyber criminals are increasingly turning their attention to smaller companies. In fact, 62% of all cyber breach victims are small and midsize enterprises (SMEs), according to Small Biz Trends. Evidence shows that this trend of targeting SMEs will continue to rise. Why are smaller businesses the favored targets of cyber criminals? Most likely because bad actors know that SME leaders often mistakenly think that cyber security services are beyond their means, making them under-protected and easily breached. Read the First Quarter 2019 Report

Did You Know?

- According to the HIPAA report, 2018 witnessed a 157.67% year-over-year surge in the number of exposed healthcare records in the US.

- As much as 80% of the data generated by the healthcare industry is likely to be in the cloud by 2020. Security is also becoming a major concern.

- The trending digitalization, such as the cloud, Big Data, mobile technologies, IoT, and artificial intelligence (AI), in ever more areas of business and society, and the growing connectivity of everything, have increased the workload of already strained IT teams.

- Source: Research and Markets